On the other hand, QuickBooks provides strong support for self-assessment tax returns preparation, compliance with HMRC regulations in the UK including a VAT error checker, enhanced visibility over cash flow, and advanced reporting tools that aid in forecasting sales trends. In effect this means,Choosing the right set of tools like Xero coupled with Link My Books can transform complex VAT management tasks into manageable ones for UK-based Amazon sellers. Choosing the right accounting software equipped with specialized tools like Link My Books can transform an otherwise daunting task into a manageable one.

These tools are designed to automate the entry and reconciliation of transactions from Amazon sales, minimizing manual data handling and reducing the likelihood of errors. Each software solution presents distinct advantages tailored towards optimizing financial management within an Amazon selling context when integrated with Link My Books-the decision ultimately rests on aligning these factors closely with your operational goals.

QuickBooks Online: Enhanced by Link My BooksSimilarly, QuickBooks Online serves as another powerful platform for Amazon sellers when paired with Link My Books. This feature allows businesses to see their sales data as it happens, enabling immediate responses to trends or issues.

Educational Support and User-Friendly DesignBeyond its core accounting functions, Xero supports its users' growth with a variety of learning resources. In-depth guidance from customer service helps Amazon sellers choose an appropriate plan based on their transaction volume and specific needs such as multi-currency support or payroll management.

Additionally, consider the level of customer support provided. It encompasses enhanced efficiency through automation, strict compliance with financial regulations, reduced risk of human error, and ultimately smarter business decisions fueled by detailed analytics and reports. Whether it's expanding product lines or exploring new marketplaces, entrepreneurs have more time to plan and execute growth strategies rather than getting bogged down by back-office operations.

Furthermore, QuickBooks updates its system to stay compliant with the latest tax laws, providing peace of mind for sellers concerned about adhering to legal standards. This integration simplifies the reconciliation process, ensuring that every transaction is recorded accurately and categorized correctly for tax purposes without seller intervention.

Understanding the scale of your operations and the level of detail required for tracking can guide you in choosing between more streamlined solutions like Wave or robust systems like Xero combined with Link My Books. As your business grows, so will your accounting needs.

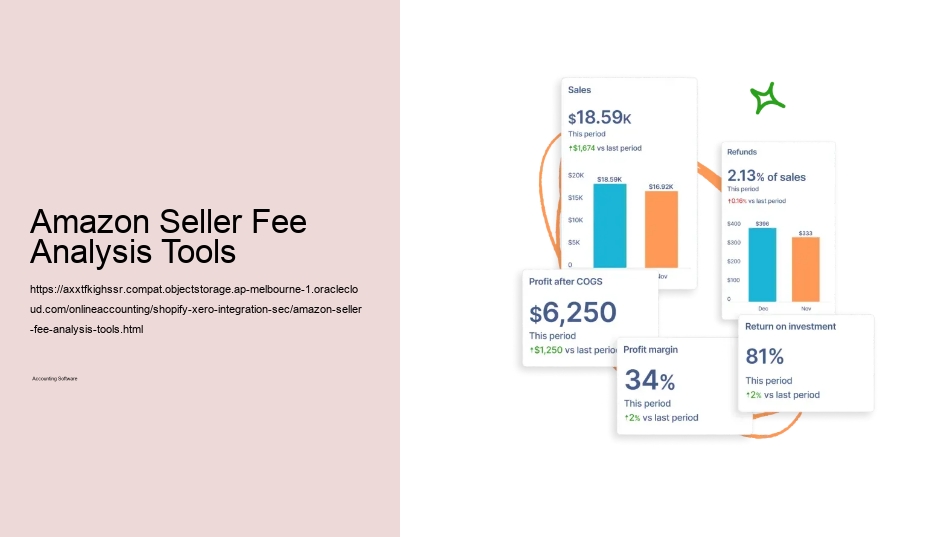

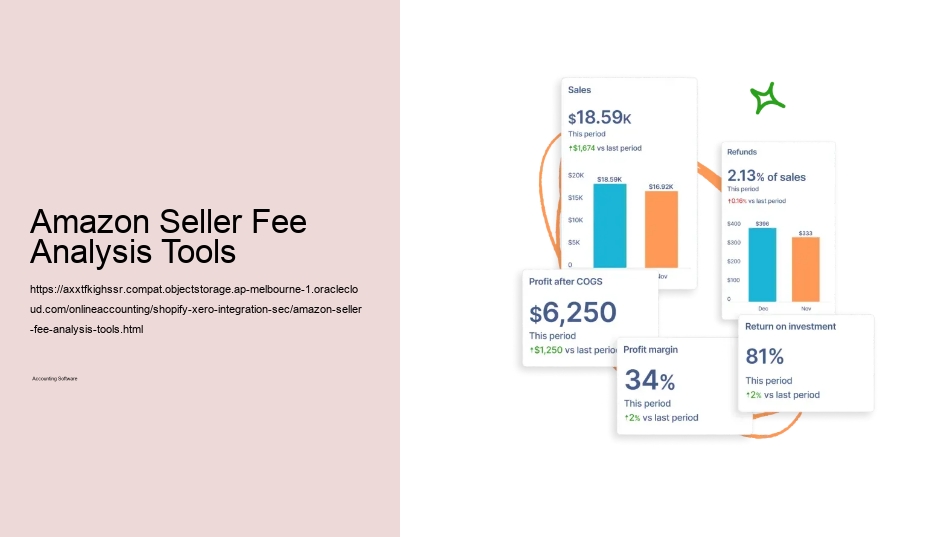

Advanced Reporting FeaturesUtilizing advanced reporting features provided by modern accounting software enables deeper insights into business performance helping sellers make informed decisions about growth strategies based on real-time data analysis. VAT management is particularly challenging due to the varying rates across different European countries and the meticulous record-keeping required by tax authorities.

The automation provided by Link My Books ensures that each transaction is categorized correctly for tax purposes, helping businesses avoid costly penalties for non-compliance. Sage helps ensure that all financial operations are in line with current tax laws and regulations. By automating processes from accurate tax categorization to simplified reconciliation between recorded sales data and actual bank statements; these tools enable sellers not just to comply efficiently with regulations but also focus more on scaling their business operations.

Automated accounting software helps ensure compliance with local tax laws through features like automated VAT calculations and returns filing directly from the application itself (as seen in Xero). Enhanced Decision MakingAdvanced reporting capabilities are among the most valued features in premium accounting packages.

Choosing The Right Accounting SoftwareThere are several accounting software options available that cater specifically to Amazon sellers' needs, such as Xero and QuickBooks when used in conjunction with Link My Books. These platforms accurately categorize each transaction by applying correct tax rates and recording fees associated with Amazon's marketplace, reducing discrepancies in financial reporting.

In effect this meansFor high-volume Amazon sellers considering whether the investment in Sage is worthwhile, it boils down to analyzing specific business needs against what Sage offers. Shopify Sales Reconciliation Navigating Complex Transaction Structures With Ease Using Modern Accountancy ToolsUnderstanding the Need for Specialized Accounting SoftwareAmazon sellers face a unique set of challenges that typical brick-and-mortar store owners do not encounter.

More importantly, it enables sellers to make informed decisions based on consistent financial information thereby supporting strategic business growth without the complexities typically associated with multi-national operations. It includes automatic updates and calculations that reduce manual input time significantly. Online classes, detailed video tutorials, and certification opportunities equip users with not only the knowledge of using the software but also best practices in financial management.

Essential Features for E-CommerceE-commerce platforms like Amazon involve complex transactions that span across different countries, each with its unique currency.

Being proficient in these tools allows you to maximize their functionalities for more efficient reconciliations. This level of detail supports strategic decision-making by highlighting areas where they are outperforming or underperforming compared to similar businesses. Pricing Structure SpecificsUnderstanding the cost implications is essential when choosing any service platform.

In effect this means... In effect this means that both Xero combined with Link My Books and QuickBooks when integrated properly provide powerful solutions designed specifically for e-commerce entities like Amazon sellers who require meticulous financial tracking without sacrificing time efficiency - ensuring all efforts are directed towards growth rather than grappling with complex accounting requirements.

This seamless connection between sales data and bank deposits aids in straightforward reconciliations. Additionally, features like automated bank reconciliation keep records up-to-date effortlessly, aligning sales deposits with bank entries accurately.

The Role of Specialized Accounting SoftwareTraditional accounting software often falls short when it comes to addressing the specific needs of Amazon sellers. Improved Accuracy and ComplianceThe seamless flow of data from Amazon to QuickBooks helps ensure that all transactions are recorded accurately and in compliance with applicable tax laws.

Tools like Xero combined with Link My Books simplify complex financial management tasks inherent to e-commerce platforms such as Amazon. Enhancing Financial Decision-Making with Real-Time Sales Updates from QuickBooksReal-Time Sales Updates: A Game ChangerFor Amazon sellers, having access to real-time sales updates from QuickBooks can significantly enhance financial decision-making. In effect this means,the right accounting software equipped with powerful integrations like Link My Books transforms raw data into actionable insights for Amazon sellers.

Automation reduces the need for frequent accountant consultations during tax season by maintaining regular and accurate books throughout the year. In effect this means,that effective customer support is integral to fully leverage accounting software solutions like Xero linked with Link My Books or QuickBooks Online for Amazon selling activities.

It's important to compare monthly fees against the suite of services each platform offers-sometimes spending a bit more can save you significantly in terms of time and manual effort. These include profit margins, inventory turnover rates, and cost per acquisition.

Overcoming Common Accounting Challenges Faced by Amazon SellersUnderstanding the Complexity of Amazon SalesAmazon sellers face unique accounting challenges, primarily due to the complexity of transactions on the platform. The software should seamlessly sync with Amazon's API to ensure that sales data, fees, inventory levels, and customer information are automatically updated and accurately reflected in your accounting records.

In effect this means,The true ROI of investing in premium accounting software for Amazon sellers extends well beyond simple cost savings. Additionally, both platforms are designed with an intuitive user interface that allows easy navigation through various financial reports at just one click away – although it is noted that some basic accounting knowledge might be beneficial when first using QuickBooks. When integrated with Link My Books, it ensures that all Amazon sales are taxed appropriately, minimizing the risk of overpayments.

Automation reduces the need for extensive manpower dedicated to accounting tasks, thereby cutting down operational costs. QuickBooks Online simplifies this complexity with tools designed to automate tax calculations and ensure compliance with local tax laws. Shopify Order Fulfillment and Accounting

With these tools at their disposal, sellers have access to user-friendly yet comprehensive ways to handle their finances meticulously without sacrificing valuable time meant for business development activities.20 . This integration not only automates the import of transactions from Amazon but also ensures accurate tax handling and simplifies the reconciliation process.

Check whether the software can handle an increasing volume of transactions without compromising performance. The software provides easy bank matching that aligns Amazon sales deposits directly to your bank records, simplifying the reconciliation process.